Global Tourism Industry

A COURSE TOWARDS THE CHANGE

Chapter 1

The global tourism industry is growing rapidly and, as it is evolving, it is facing new challenges that are influencing the sector. In this topic we highlight the most important factors that are going to play a significant role in the evolution of the industry and will have implications in the decisions of policy makers, institutions and corporations when choosing their goals, deciding about their long term policy and developing their short and long term business and marketing plans to handle business challenges on a national and international level. This article is an effort to connect different aspects related to the global tourism industry using information and opinions from different and reliable sources, aiming at the creation of a solid base to re-think tourism global policy, future actions and business proposals.

The Global Tourism Industry article will be presented in 4 differently connected chapters reaching different aspects of the issue, that as a whole are compose the long INDUSTRY’S COURSE TOWARDS A CHANGE.

This is the first Chapter : Global Tourism Key Facts, Mega Trends and Long Term Outlook 2016-2026

Chapter 1: Global Tourism Key Facts, Mega Trends and Long Term Outlook 2016-2026

1.1 Global Tourism Key Facts

- Tourism flows were influenced by three major factors in 2015: the unusually strong exchange rate fluctuations, the decline in the price of oil and other commodities, and increased global concern about safety and security.

- Travel and tourism represented approximately 10% of total global Gross Domestic Product (GDP) in 2015 (if we include tourism related businesses (e.g. catering, cleaning) (US $7 trillion).

- International tourism accounts for 30% of global trade in services.

- Travel & Tourism investment in 2015 was USD774.6bn, or 4.3% of total investment. It should rise by 4.7% in 2016, and rise by 4.5% pa over the next ten years to USD1,254.2bn in 2026 (4.7% of total).

- The number of international tourist arrivals (overnight visitors) in 2015 increased by 4.6% to reach a total of 1186 million worldwide, an increase of 52 million over the previous year. It was the sixth consecutive year of above-average growth in international tourism following the 2009 global economic crisis.

- By UNWTO region, the Americas and Asia and the Pacific both recorded close to 6% growth in international tourist arrivals, with Europe, the world’s most visited region, recording 5%. Arrivals in the Middle East increased by 2%, while in Africa they declined by 3%, mostly due to weak results in North Africa.

- France, the United States, Spain and China continued to top the rankings in both international arrivals and receipts. In receipts, Thailand climbed three places to 6th position, and Hong Kong (China) climbed one place to 9th. Mexico moved up one position to come in 9th in arrivals.

- Forecasts prepared by UNWTO in January 2016 point to a continuation of growth in international tourist arrivals at a rate of between 3.5% and 4.5% in 2016, in line with the Tourism Towards 2030 long-term projection of 3.8% growth a year for the period 2010 to 2020

- The sector supported 284 million jobs.The global travel and tourism industry created approximately 11% of the world’s employment (direct & indirect) in 2015. Travel & Tourism grew by 3.1% in 2015 – the 6th consecutive year of positive growth for the sector.

- The average international tourist receipt is over US$700 per person and travelers spent over $1.4 trillion.

- Visitor exports generated USD1,308.9bn (6.1% of total exports) in 2015. This is forecast to grow by 3.0% in 2016, and grow by 4.3% pa, from 2016-2026, to USD2,056.0bn in 2026 (6.2% of total).

1.2 Long Term Outllook 2016-2026

- By 2026, Travel & Tourism is expected to support 370 million jobs in total globally, which will equate to 1 in 9 of all jobs in the world.

- South Asia, by some distance, will be the fastest growing sub-region for total Travel & Tourism GDP long-run growth to 2026 (7.1%) as India (7.5%) outpaces China (7.0%). The next tier of sub-regions, with growth of 4%-6% in total Travel & Tourism GDP, includes Southeast Asia (5.8%), followed by Northeast Asia (5.6%), Sub-Saharan Africa (5.2%), the Middle East (4.9%) and North Africa (4.2%). Meanwhile, growth in Latin America (3.7%), North America (3.5%), the Caribbean (3.4%) and Europe (2.8%) is expected to average below the global average of 4% per year.

- Some of these regional growth rates should however be seen in the context of past performance. North Africa’s total Travel & Tourism GDP growth averaged -2.8% between 2010 and 2015. By 2026, North Africa’s total Travel & Tourism GDP will only be 33% higher versus 2010 levels, compared to a growth over the same period of 178% for Southeast Asia. China, the USA, Germany and the UK will remain the top four markets by 2026 for outbound spending. India, Indonesia and Singapore will make noticeable moves up the global league table for outbound spending.

- The fastest growing G20 countries for total Travel & Tourism GDP to 2026 will be China, India, Indonesia, Mexico and South Africa. Amongst the smaller non-G20 economies, Kyrgyzstan, Myanmar, Tanzania, Vietnam, Uganda, Namibia and Zambia are expected to show the strongest growth. India’s strong forecast growth will propel it into the top ten Travel & Tourism economies by 2026, moving from 12th in 2015 up to 7th by 2026 in terms of total Travel & Tourism GDP.

- Chinese outbound travel is a global powerhouse, largely because of the sheer numbers and increasing spending power of Chinese tourists. There is another factor behind this worldwide travel surge: the Chinese love to travel. As this year’s CITM has shown, two-thirds of outbound Chinese travelers consider travelling to be an essential part of life – and are prepared to spend nearly a quarter of their income on travelling.

- In line with last year’s predictions, China is still expected to overtake the USA in terms of Travel & Tourism investment by the end of the forecast period – but remains behind the USA in terms of Travel & Tourism total GDP, direct GDP, domestic spending and visitor exports.

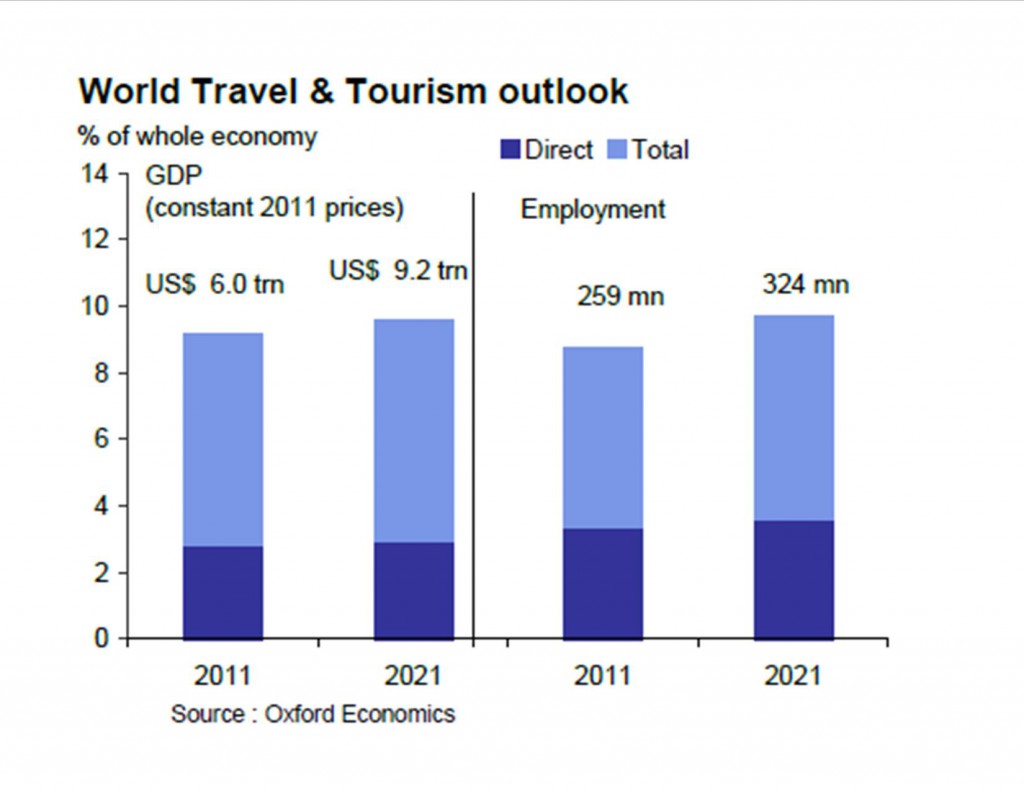

- The World Travel and Tourism Council estimates that the total impact of travel and tourism on global economic output will reach $9.2 trillion by 2021.

1.2.1 Regional Results

Europe: International tourist arrivals in Europe grew by 5% in 2015 to reach a total of 608 million, just over half the world’s total (51%). Europe was the fastest growing region in absolute terms, with 27 million more tourists than in 2014. This is a remarkable result considering the maturity and size of many European destinations. International tourism receipts grew by 3% in real terms to US$ 451 billion (euro 406 billion), representing 36% of worldwide receipts. A weaker euro in 2015 has boosted the region’s appeal to non-euro markets, and the recovery of many European economies has fuelled intra-regional tourism.

Asia and the Pacific: Asia and the Pacific welcomed 279 million international tourist arrivals in 2015, 15 million more than in 2014, corresponding to a 6% growth. The region earned US$ 418 billion in international tourism receipts, an increase of 4% in real terms. Asia and the Pacific accounts for 24% of the world’s arrivals and 33% of receipts. By subregion, South-East Asia (+8% in arrivals) and Oceania (+7%) recorded the strongest growth.

The Americas: Following the strong results recorded in 2014, international tourist arrivals in the Americas grew by 11 million (+6%) in 2015 to reach 193 million (16% of arrivals worldwide). International tourism receipts increased by 8% in real terms to US$ 304billion (24% of receipts worldwide). Many destinations benefited from the appreciation of the US dollar, driving tourism demand from the United States, with the Caribbean and Central America (both +7%) leading growth.

Africa – Gradually returning to growth: International tourist arrivals in Africa are estimated to have decreased by 3% in 2015 as the region continued to struggle with health and security challenges, as well as slower economic growth due to lower oil and commodity prices. Africa welcomed 53 million international tourists and earned US$ 33 billion in international tourism receipts (+2% in real terms) to maintain a 5% share in worldwide arrivals and a 3% share in tourism receipts. These figures should, however, be interpreted with caution, as results are still based on comparatively limited data.

Middle East – Consolidating recovery: International tourist arrivals in the Middle East (+2%) are estimated to have grown by 1 million in 2015, increasing the total to 53 million. The region has consolidated the rebound that started in 2014, when arrivals increased by 7%, following three years of decline. International tourism receipts increase by 4% in real terms to US$ 54 billion. The Middle East has a share of over 4% in both worldwide arrivals and receipts.

1.2.2 Top spenders in international tourism-The Republic of Korea enters the Top 10 source markets

China, the United States and the United Kingdom led outbound tourism in their respective regions in 2015, fuelled by strong currencies and economies.

China continues to lead global outbound travel, after registering double-digit growth in tourism expenditure every year since 2004, benefitting Asian destinations such as Japan and Thailand as well as the United States and various European destinations. Spending by Chinese travelers increased by 26% in 2015 to reach US$ 292 billion, as the total number of outbound travelers rose by 10% to 128 million.

Tourism expenditure from the world’s second largest source market, the United States, increased to US$ 113 billion in 2015, while the number of outbound travelers grew to 73 million.

The United Kingdom, the fourth largest source market, led growth in outbound demand in Europe, supported by a strong British pound in relation to the euro. UK residents’ visits abroad were up by 5 million to 64 million in 2015, with US$ 63 billion spent in international tourism. Demand from other major markets was more subdued, partly due to weaker currencies.

Germany remained the third largest source market with a slight decrease in expenditure last year to US$ 78 billion. France (US$ 38 billion) also reported a decline, but still moved up one place in the ranking to 5th position.

The Russian Federation (US$ 35 billion) moved down one place to 6th position despite a 10% increase in expenditure in 2015.

Canada remained in 7th place with US$ 29 billion in expenditure.

The Republic of Korea reported a robust increase in spending to US$ 25 billion, and moved up six places to enter the Top 10 in 8th place. As a consequence, Italy (US$ 24 billion) and Australia (US$ 23 billion) both moved down one place in the ranking to 9th and 10th position respectively.

Other source markets in addition to the Top 10 which showed double-digit growth in expenditure last year were: Spain, Sweden, Taiwan (pr. of China), Kuwait, the Philippines, Thailand, Argentina, the Czech Republic, Israel, Egypt, and South Africa.

1.3 Global Tourism Mega trends

Global Tourism is affected by many factors which are changing rabidly leading international and national markets and economies to rethink their goals, business policy, strategy and of course their tactics. Presented here are the most important global trends and factors which will influence mid- and long-term tourism development and should influence national business plans. We classify them into two main categories. The first category of trends and actors will have a major influence on demand in the tourism sector but will also impact the second set, which concerns changing supply. Together they represent the forces that will radically shape the future of the tourism industry on a global and local economic scale.

1.The global population is aging and as a result a significant tourist segment is emerging – Silver hair tourists – with specific desires and needs in terms of customization, service consumption, security and desired products. In keeping with the socio-demographic trend, the aging population is considered one of the fastest growing segments in the tourism market.

The percentage of the world’s population over the age of 60 increased from 8% in 1950 to 12% in 2013. According to forecasts, this percentage will reach 21% by 2050. The aging population will increase specifically in China, India and the US where each country is expected to have a population with over 100 million people aged 60 or above by 2050.

With a satisfactory disposable income, less home responsibilities, more time to travel and relatively good health, they are an important tourist segment and are expected to spend more than all other age groups on holiday travels.

2.Generation Y, also known as Millennials, andGeneration Z, known as iGen, are likewise appearing as an influence. These are tech savvy, technology driven age groups, very different from one another, with specific needs for communication, consumption and tourist experience.

This rapidly growing segment, the Millennials, as they are known, is expected to represent 50% of all travelers by 2025. Their focus is on exploration, interaction, and emotional experience and many brands in the hotel industry have realized that they need to rethink the service they provide to accommodate these dimensions.

On the other hand, the impact of generation Z on tourism, is yet to become apparent. This generation, also called “Click ‘n go children” or “Screenagers”, range in age from 6 to 20 (although age limit is not yet precisely defined) and in the US already a quarter of the whole population belongs to generation Z (USA, Census 2010).

A prediction of their lifestyle and living environment presents a more radical shift from generation Y, than was the shift from generation X to generation Y. Generation Z is believed to be totally different from generation Y in so much as they already have higher access to information, a more dynamic lifestyle, and a higher level of education, an accelerated adoption of change and faster spending. As well as strategic planning, in order to win them over, companies will have to become more agile and better understand their personalities.

3.Rising global traveling class. The middle-class population is expected to increase further, up to 4.9 billion by 2030, where most of the growth is expected from Asia. Their characteristics will have a growing importance and impact on the tourism sector.

The majority of global middle-class growth will come from the Asia-Pacific region, where growth is substantial. By 2030, the Asia-Pacific region will already represent two-thirds of the total global middle-class population and will contribute to 59% of all middle-class consumption by 2030. Growth in the middle-class market within the Asia-Pacific region will be driven mostly by growth in China and India. Forecasts for 2020 say that Chinese GDP per capita will increase 1.5 times compared to the GDP per capita in 2014, while India’s will grow around 1.8 times.

Conversely, the middle-class population in Europe and North America will stagnate, resulting in a decrease of their share by more than double by 2030.

4.Loyalty as we know it so far will change. The sign up form process will change and will be less complicated. A new digital environment and the Big Data availability will allow companies to better understand their customers’ needs and to design tourism products that match the customers’ needs achieving higher customer satisfaction.

5.Health and healthy lifestylewill become increasingly important in tourists’ decision making. Aging tourists, the lifestyle of Millennials and iGen, a growing middle class, and the technological and digital revolution, all contribute to boosting the importance of the health trend. Health and healthy lifestyle will become progressively more integrated into multiple dimensions of tourism offerings.

6.Increasing connectivity. The forces of globalization and technology are shrinking distances. Construction of more than 340 new airports is expected over the next decade, creating new routes and destinations that will make international travel easier and more convenient. At the same time, awareness of alternative modes of transportation, accommodation, destinations, cost and other travel options is spreading with the rapid uptake in Internet access and the number of mobile devices around the world. Digital connectivity is not only fostering greater spontaneity in travel, but also a broader array of personalized travel and tourism options as well.

7.Emerging Destinations. With the growing middle class and their search for value for money and different travel interests, many destinations in the emerging and developing regions (Asia, South America, Eastern Mediterranean, Middle and Eastern Europe, Middle East and Africa) have managed to develop and exploit their tourism potential to attract and retain visitors. These countries will soon have more international arrivals than developed markets (North America, Western Europe, developed areas of Asia and the Pacific). In 1950, while almost all of the international arrivals (97 percent) were concentrated in only 15 destination countries, this share had fallen to 56 percent by 2009. Currently there are close to 100 countries receiving over 1 million arrivals a year.

8.Financial Markets’ Turmoil. Today’s travelers are increasingly aware of events unfolding all over the globe, causing them to respond and change their travel plans based upon the latest news. As travelers make more decisions in real-time, so will the destinations and service providers that cater to their needs.

Take, for example, the financial market turmoil in several emerging economies over the last year. In China, the stock market lost more than one-third of its value. The Brazilian economy is now mired in a deep recession and its currency has fallen sharply in value. In Russia, the plunge in oil prices has caused a dramatic slowdown. Weakening economies in all of these countries have a direct impact on the tourism industry. For starters, significant declines in the value of their currencies typically make it more expensive for their citizens to travel abroad. Likewise, the fall-out from a loss in confidence about the economy can make travelers more reticent about taking a vacation and less likely to go. The impact of the financial market turmoil on travelers is different in every country and obviously it is not the same around the globe. Russia saw the biggest fall-off in 2015, with a 26 percent drop in the total number of international trips from the previous year. Brazil experienced an overall decline of about 14 percent year-over year. Meanwhile, international travel in China held relatively steady, posting a modest 13 percent increase in 2015 from the previous year. Understanding these travel patterns is critical for business and policy entities which must adapt in order to make their business plans.

9.Production and investments transfer from Europe and US to the East is contributing to changes related to disposal income and will redefine the global tourism destinations and spending per nationality. The emerging markets will soon overtake developed markets in terms of international arrivals with 58% of the share. As it stands, in the top 20 global destinations by international overnight visitors (2015), 10 cities are from the Middle East and Asia, and half of them experienced double digit growth between 2009 and 2015. The middle-class population is expected to increase further, up to 4.9 billion by 2030, where most of the growth is expected from Asia.

10.Political Issues & Terrorism. As new destinations emerge at a time of global change, we are witnessing how ethnic, cultural and religious differences together with different political agendas across the globe can cause various tensions. As a result political unrest, terrorist attacks and civil riots are becoming more of a reality. All such things impose a threat to the future of tourism.

Governments around the world are facing numerous political issues that might influence tourism in certain destinations. For example, riots in Greece have affected Greek tourism both in the short and long-term. Short-term problems occurred with the media warning tourists to avoid traveling to Greece. Long-term concerns might be losing investments and investors’ confidence in the tourism sector due to financial instability. An example of a recent political issue is the EU’s struggle with the flow of migrants and its own asylum policies. More than 800,000 refugees have already arrived this year in Europe and the European commission estimates up to three million refugees arriving in 2016. How to solve this problem remains a pressing question for the EU.

Terrorism threats or tragic events might cause a major setback for any destination, but in a tourist destination it is also likely to decrease the number of international visitors. The most recent tragic attacks in France are opening key questions on how to address this global threat. Other recent terrorist attacks that have occurred in Egypt, Tunisia and Thailand, had a direct negative impact on tourism. Crisis management is therefore becoming a necessity for destination managers.

Transportation insecurity is also a potential issue for travelers, often caused by terrorism attacks in airports and on trains. Europeans currently fear for the security of their rail system after the attempted terrorist attack which occurred in France in the summer of 2015. Furthermore, travelers are facing a problem of waiting longer at security check points before boarding and they might face further inconvenience by having difficulty in storing their baggage at the airport due to security reasons.

11.Digital Channels. Conducting our lives online is swiftly becoming the norm rather than a novelty. Mobility (smartphones, smart gadgets, wearables) and social networks – so-called SoMo (Social + Mobile) – are channels which still have room for further growth.

Generally speaking, the process of a vacation begins and ends with the Internet. It starts with research and collection of ideas, through to an intent to travel, then fine tuning the trip details and ultimately sharing experiences after the trip. After returning from a vacation, guests are now providing feedback about their experience via the same social networks (Facebook, Twitter, Instagram) and distribution channels by which they gathered information for their trip in the first place (Tripadvisor, Booking, Airbnb).

On average, almost every person in the world owns a cell phone, and soon the ratio will be greater than 1:1, meaning that most tourists will be able to explore, plan and make decisions wherever and whenever they want. Currently 65% of searches begin on mobile phones and continue on computers. In 2013, time spent on smartphones exceeded time spent on a PC. In 2014 time spent using mobile devices exceeded time spent watching TV. In Q3 2013, on average, people spent 34 minutes on a mobile search versus 27 minutes spent on a PC search. In Q3 2014, the daily average time spent on mobile devices was 177 minutes versus 168 minutes spent watching TV.

Sixty percent of time spent on the Internet is dedicated to social networks. Since social networking exceeded gaming activities, it became the first activity on mobile apps. Twenty-eight percent of the global population is using social networks and 77% of them access social networks via mobile devices. Facebook has become a serious player in the world search; the daily number of searches on Google is 3.5 billion compared to searches on Facebook with already 1 billion.

The importance of social networks in tourism is increasing. Some examples are the interaction with the guest, targeted communication, location services, the confidence in friends’ recommendations, and creating and sharing content by guests. For instance, 48% of business travelers and 40% of leisure travelers in the United States enjoy sharing travel experiences online.

Tourists tend to spend a lot of their time online. The global market of wearable devices will nearly triple by 2019 with a predicted average CAGR of 35%. Some wearable devices used nowadays include earpieces, digital glasses and smart watches. An example would be the wireless ear piece headphones, “The Dash” which enables users to listen to music, track body performance or even communicate via an ear bone microphone.

Sales by global on-line travel intermediaries grew 8% CAGR over the period between 2008 and 2013, and now stand at 25% of the total travel sales (Euromonitor).

12.Sustainability. The negative impacts of tourism on societies and environment over time makes a gradual shift of the tourism model to more sustainable forms a must in the years to come. Economic, social and environmental pillars have to be balanced in order to ensure the long-term sustainable development, orderly functioning and survival of the tourism industry.

- Globally, 69% of travelers plan on trying something new in 2016, 15% want to try adventure travel for the first time, and 47% say they have visited destinations because of the people and culture of specific countries.

- ‘Living like a local’ has become an essential part of getting under the skin of a destination for many travelers. They are looking for more authentic holiday experiences and many holiday companies are now offering people the chance to enjoy hidden gems alongside traditional tourist attractions.

- Nature-based tourism accounts for about 20% of total international travel and continues to grow, according to the UNWTO.

- Research studies continue to show that travelers prefer companies that embed green or eco-friendly practices into their operations.

- The percentage of consumers who are willing to pay more for sustainable brands that showed commitment to social and environmental values went up from 55% to 66% between 2014 and 2015. About 73% of the younger generations — Millennials and Generation Z — are more likely to pay more for sustainability, compared to 51% of Baby Boomers.

- There is a consensus among specialists that we are currently experiencing a “New Tourism.” These new tourists have a higher level of environmental and cultural awareness, which means that, as a result of the generalization of ICTs and social networks, they are more demanding, more able to influence, and have their say on the products that they consume.

- The massive impact that climate change will have on tourism destinations and tourism businesses has only just begun to sink in. Add to that rising energy prices, water shortages, declining biodiversity, let alone concerns about wages, human rights and basic entitlements for employees in the tourism industry, and it looks very much like a ‘perfect storm’ of pressures. All the more reason to look to the industry leaders [who are] putting the practice of sustainable tourism at the heart of their enterprises. This is now a fast-moving, extremely dynamic area: those that get it right will thrive; those that don’t will perish,

- In response to growing demand by tourists for environmentally and socially responsible products and services, marine- and coastal-based tour operators are increasingly seeking to improve their environmental and social performance, both by changing their own practices and by contracting with marine recreation providers that follow recognized good practices.

- ’Green’ tourism businesses continue to receive differentiation in popular online travel search and booking engines, including TripAdvisor GreenLeaders, Travelocity, and Expedia. Travel bloggers focused on ecotourism, cultural-heritage tourism, and unique vacation experiences continue to gain traction.

Some examples of businesses demonstrating the economic and strategic benefits of sustainability include:

- Starwood Hotels and Resorts has announced major Global Citizenship goals: a 30% reduction in energy, a 20% reduction in water consumption, and a 30% reduction in GHG emissions per built hotel room by 2020.53

- In December 2014, JetBlue partnered with The Ocean Foundation and A.T. Kearney to release the study “EcoEarnings: A Shore Thing,” which “marks the first study to directly correlate the long-term health of the Caribbean shorelines to JetBlue’s investment in the region and bottom-line.”54

- Soneva Fushi Resort in the Maldives was able to cut food waste by 50% after a comprehensive food waste audit led by LightBlue Environmental Consulting Company.55 According to LightBlue, “A standard 4-star all-inclusive beach resort that serves 45,000 meals per month can waste up to 154,767 kilos of food per year, enough to feed 22,319 families of four! The true cost of food waste, including energy, water and labour cost, can reach a staggering $ 700,000 per year for one 5-star hotel.”56

- In 2013, Chiva-Som resort in Thailand worked with the Clinton Climate Initiative’s Energy Efficiency Building Retrofit Program. The results included that lighting and air conditioning systems were replaced resulting in a 26% reduction in monthly electricity consumption and a related 20% reduction in carbon footprint.57

- The Rainforest Ecolodge in Sri Lanka became the first hotel in the country and the fifth in the world to be awarded the LEED Platinum Certification (Leadership in energy and Environmental Design) by the US Green Building Council (USGBC). This is the first accommodation in Sri Lanka which has been crafted using recycled shipping containers as the shell of each individual lodging facility.

Read More At : Globalization’s Impact on Tourism.

References:

- UNWTO-World Tourism Organization: Tourism Highlights Edition 2016

- Worth watch Report: Tourism Megatrends / 10 things you need to know about the future of Tourism.

- World Travel Tourism Council: World Economic Impact 2016/ Annual Update Summary.

- Mapping the future of Global Travel & Tourism: Visa

- Affluent Insights Report Summary: 2016 Chinese Travel Consumer Report

- International Trade Center: Tourism and trade: A global Agenda for sustainable Development

- Travel & Tourism: Economic Impact 2015/World

- Sustainable Tourism (CRC)MEGATRENDS UNDERPINNING TOURISM TO 2020/Analysis of key drivers for change

- Horwath HTL: Tourism Megatrends / 10 things you need to know about the future of Tourism

- Statista: Statistics and facts on the global tourism industry

- UNEP: Facts and Figures about Tourism

- World Economic Forum: The Travel & Tourism Competitiveness Report 2015

- Messe Berlin: ITB WORLD TRAVEL TRENDS REPORT 2015 / 2016

- Intex Mundi: International tourism, number of arrivals – Country Ranking

- UNWTO: Tourism Towards 2030 Global Overview

- China Daily: Chinese travelers lead 2015 global outbound tourism

- World Tourism Organization UNWTO: International tourism continues to grow above average in the first four months of 2016, 19 Jul 2016.

- OECD: Tourism Trends & Policy 2016

- Asian Development Bank: Pacific Economic Monitor: December 2015 – Budget Analysis

- Hotels.com: Chinese International Travel Monitor 2016

- bcg Perspectives: Travel and Tourism: Capitalizing on Increased Demand and Better Operational Performance,

- Center For Responsible Travel: The Case for Responsible Travel: Trends & Statistics 2016.

Leave A Comment